The Of Term Life Insurance

Table of ContentsCancer Life Insurance Can Be Fun For Anyone

depends upon your private demands. A term life plan makes feeling if you assume you only will need insurance coverage for a period. Term life likewise has a tendency to be a lot more economical than entire life, so it can make feeling for those concentrated on staying within a budget plan. "Term insurance coverage is excellent for a person who has an insurance need for just an established variety of years,"states Jason Wellmann, elderly vice president of life distribution at Allianz Life.

Whole life insurance coverage also makes good sense for those who intend to lock in one superior rate as well as maintain that expense for as long as they live."The survivor benefit stays in place for the entire life time of the insured, as long as adequate premiums are paid, "Wellmann claims. Whole life also offers a" cash money value"account that attract those wanting to build up a bigger pool of savings. You can access money value in the type of a lending or withdrawal from the cash money value. The money could be used for points such as: Aiding with a youngster's college education and learning, Funding retired life earnings, Spending for emergency expenses, Just how to choose a life insurance policy protection quantity? You may ask yourself,"Exactly how much life insurance policy do

I require?" When buying life insurance policy, choosing the correct amount can be challenging. Some specialists suggest buying an advantage that will pay seven to 10 times an insurance holder's yearly income. Working very closely with a life insurance policy agent can help you determine exactly how much coverage you need provided your special situation. Whole life insurance Louisville. How a lot does life insurance policy cost?Average life insurance policy cost is a bit of a misnomer since the cost of a life insurance policy can vary commonly by person. Ladies live longer, so they tend to pay lower premiums. Much healthier people pay reduced costs than those with some clinical problems. You will certainly pay greater costs if you smoke. People with high-risk pastimes-- such as skydiving-- might pay greater costs. Jobs that include more physical dangers can lead to higher costs. If you're looking for inexpensive life insurance policy, know that term life insurance coverage is

usually normally more affordable whole life coverageInstance Just how to save money on life insurance policy? The most effective life insurance policy policy is the one that totally fulfills your needs. Buying life insurance policy is constantly a balancing act in between getting the coverage you need as well as snagging the very best life insurance policy rates."Determine what is essential to your economic strategy and assess each year."Another crucial method to conserve is to compare life insurance rates. This way, you can discover the very best plan at the most effective price. Exactly how to get life insurance policy quotes? You have numerous options for acquiring life insurance policy quotes. One technique is to tighten a list to a number of insurance companies and to acquire specific quotes from each of them, either by calling their offices or utilizing their internet site

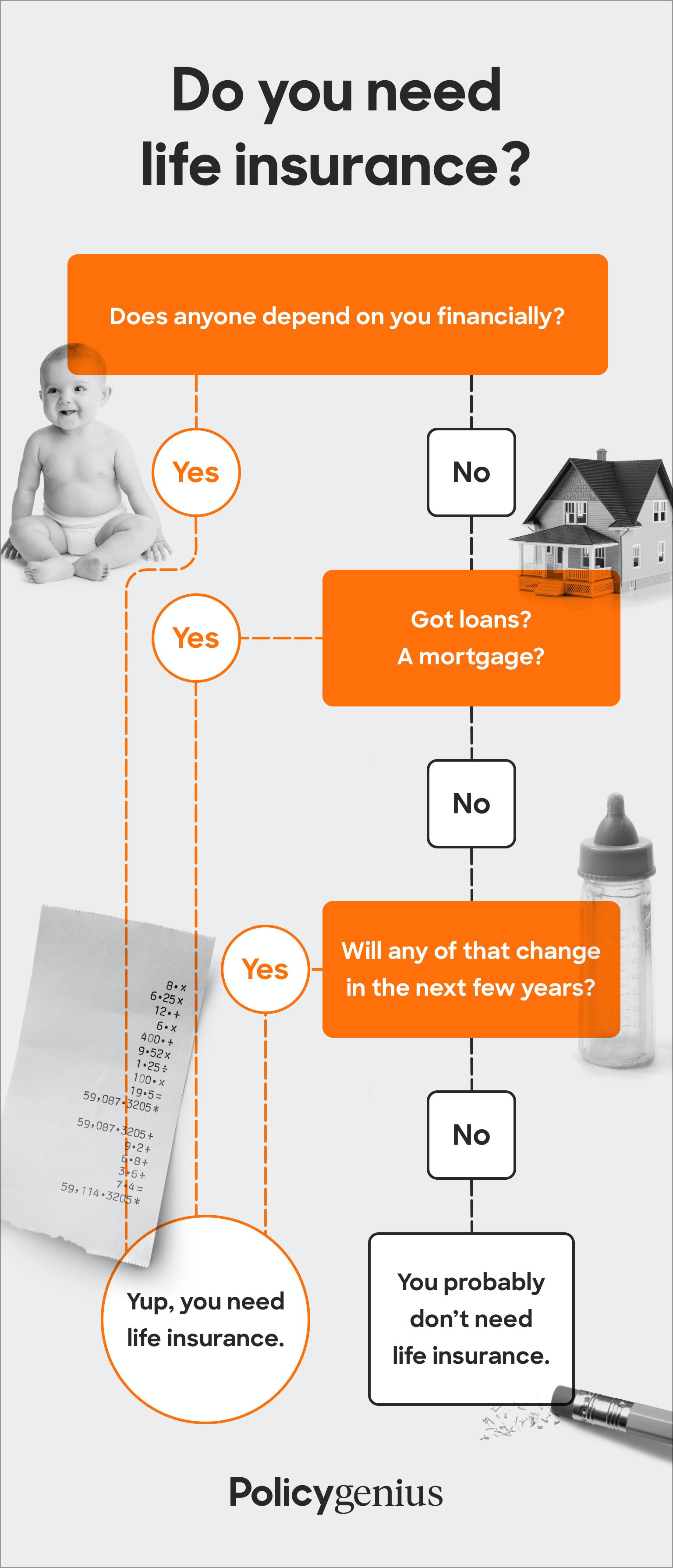

. Obtaining life insurance policy prices quote online is just one of the most effective methods find out to save. Among the simplest as well as quickest ways to gather quotes is to utilize a service like the one supplied by Just key in your postal code and also you will rapidly obtain a number of life insurance prices quote in simply a few minutes. Right here are some inquiries to respond to: Do you have liked ones relying on your income for their wellness? Exists a favorite charity or cause you wish to sustain economically? Do you wish to offer cash to cover your last expenditures? Depending on your goals, you may assign one or even more individuals to be recipients. Alternatives might include: Every one of the fatality advantages get here in a solitary payment (American Income Life). Some recipients find it easier to obtain the cash slowly over a period. Some insurers may permit a recipient to maintain the fatality benefit

in an interest-bearing account. Recipients can then create checks against the cash in the account. Unless the annuity is established for a set duration, any continuing to be survivor benefit staying when the recipient passes away will certainly go back to the insurance policy business. Life insurance company. Exactly how does a beneficiary make an insurance claim? The Insurance policy Details Institute advises